What is Hamptons Style? Characterised by its casual elegance and fresh, sophisticated aesthetic, Hamptons style draws inspiration...

Dreaming of a lush garden but only have a tiny outdoor space? Don’t let that stop you!...

Blog Introduction: If you’re looking to give your living room a makeover in the near future, you’re...

Hollywood and traditional media are often criticized for their lack of racial representation, but online media has...

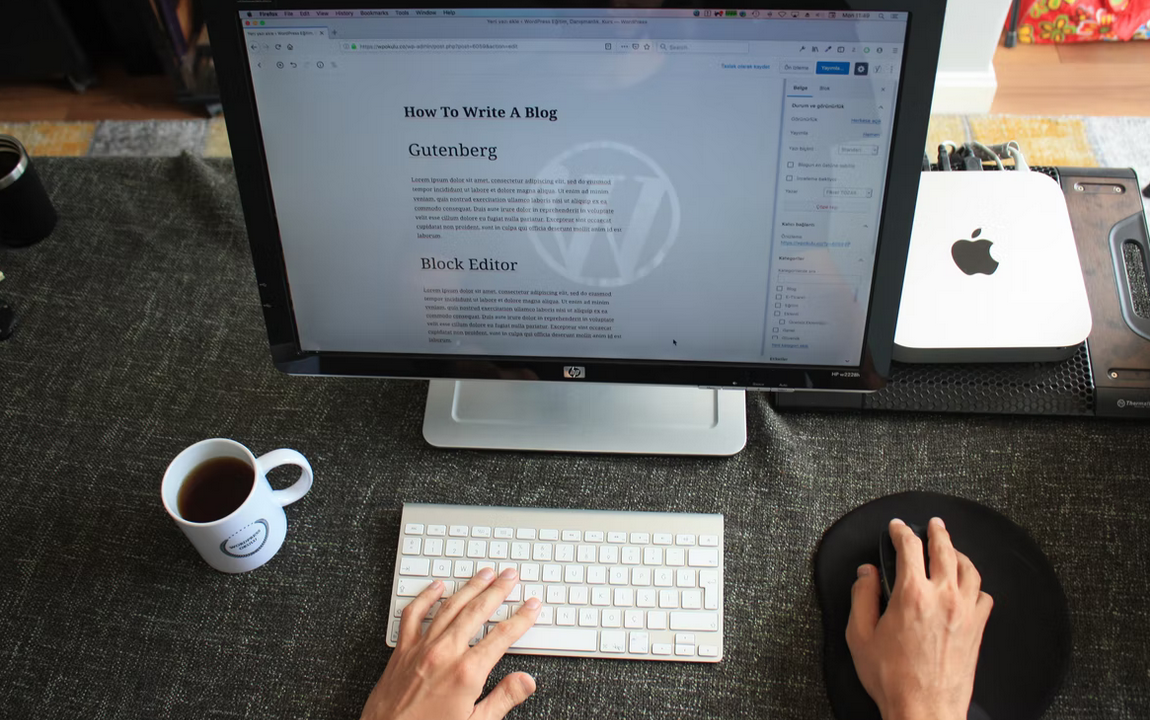

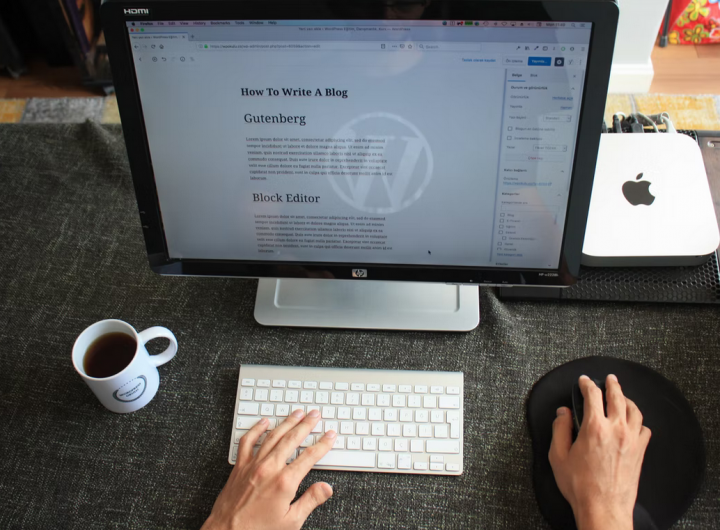

There are a number of wordpress page builders available on the market, each with their own set...

After an intense workout, it is likely for your muscles to feel sore and your energy minimal....

Google Data Studio is a free business intelligence made by Google. It helps companies centralise their reports...

The rapid growth of the gaming industry shows no sign of stopping or even slowing down. The...

In this cutthroat digital marketing competition, customer interaction is no longer a one-time thing. Customer service and...

Display ads can come off as annoying to users. They can be too invading if they don’t...

Tiktok is a new social media platform that skyrocketed within the first year of launching. It is...